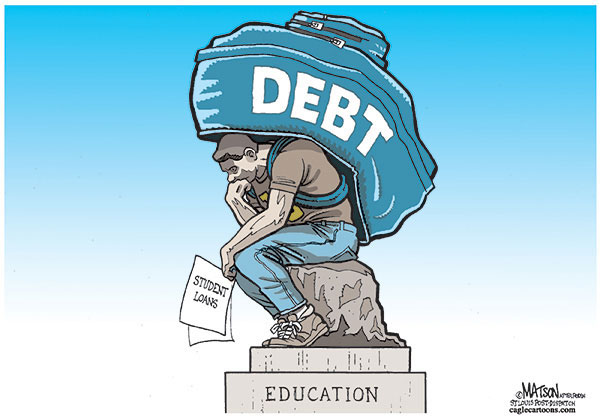

Student Loans and How to Avoid College Debt

According to student loan and refinancing website LendEDU, there are approximately 43.3 million people total in the U.S. who have borrowed money to pay for college through student loans as of July 1, 2016. The total amount of remaining student loan debt is $1.35 trillion. And 60 percent of college graduates leave their universities with student loan debt. College debt is not an unknown thing to a significant number of Americans.

And theatre teacher Terry Harbison has become well acquainted with it. He first went into debt when he was halfway through college, after the scholarships that covered his first two years had dwindled away. After he had graduated from college and entered the workforce, he was able to pay them off.

“They have repayment plans so I made sure I paid more than just the minimum,” Harbison said. “I just payed every month and chipped away and chipped away. [And] eventually that was gone.”

But those loans did not go away quickly. It took about eight or nine years for Harbison to pay off the loans from his bachelor’s degree. However, it did serve as a valuable learning experience that he can pass on to others.

“You need to get a degree that’s going to pay you some money. You need to be smart and wise [about paying for college]. If you have a scholarship, that’s awesome. But if you can get your basics at a junior college, do that, especially if you’re unsure of what [field] you’re going to go into,” Harbison said. “Take some time [and] figure out what you’re going to do. Take good classes [and] pay for it as you can. But don’t blow money.”

Although having student loan debt has left him with less income that he can freely use, Harbison does not regret having college debt. He sees it as making an investment into his own future, rather than as a mere stumbling block or restraint.

“To be paying on it [his future] into the future … It’s frustrating, but unfortunately it’s kind of the nature of the beast, as it were,” Harbison said.

Although it may be said by other adults often, the best way to prevent and avoid college debt is to work hard, according to Harbison. He believes that finding some kind of activity — whether it be academics-related, band, sports, or a fine art — to excel in will make it easier to get a scholarship and by extension, save money and prevent debt. In addition, Harbison suggests going to community college for general education in order to save as much money as possible. That way, the money that was saved can be utilized to pay for tuition during the last two years of college that focuses on one’s major and may warrant transferring to a more costly school. Or, for students who have the discipline to go back to school, Harbison encourages them to take time off, if necessary.

“Don’t feel like you have to push through in four years,” Harbison said. “If you need to take a break, work and make more money, do that.”

To senior guidance counselor Amanda Findlay, the importance of students having a definitive plan for college and afterwards is high. The lack of skill and discipline to budget income as well as debt deters students from successfully paying off debt according to her. She believes that scholarship searches should be continuous and that students should do what they can such as working while in college to aid in reducing the necessity to use loans.

“The trick is to incur less debt by knowing what type of post-secondary training you need to enter the workforce in your chosen profession,” Findlay said. “Minimizing changing your major will allow students to graduate [from] college in four years instead of five, saving them a year’s worth of tuition and expenses.”

In Findlay’s opinion, high school students’ top priority when preparing to enter college should be to find and acquire a job. She also thinks that in order to prevent students from using college as a way to try to figure out what they want to do, such as switching majors and simultaneously building up debt, they should know what major or at least what field of work they want to go into prior to entering college. The next step is being knowledgeable about what kind of training and qualifications a certain position or career requires in order to heighten the chance of obtaining a particular position or entering a specific career.

“I think we have to do a better job determining interests, skills and abilities in high school so that everyone who graduates has a plan for post-secondary training that fits with the goals they have for their life. That includes knowing the JOB they want to pursue as a career,” Findlay said. “[And] simply because a student is offered a loan doesn’t mean they have to take it, or take the full loan amount. Take only what loan money is needed, [if at all].”